Is actually 570 good credit?

The fresh new FICO get range, and this selections regarding 3 hundred in order to 850, is actually widely used by the lenders and you can creditors due to the fact an assess away from creditworthiness. Perhaps you have realized lower than, a 570 credit score is regarded as Poor.

Of many loan providers prefer to not provide in order to consumers having bad credit results. Thus, your ability to help you borrow cash and investment choices are going to become limited. That have a score out of 570, your notice are on strengthening your credit score and you can elevating your own fico scores before applying for any funds.

One of the recommended a means to create borrowing from the bank is via are added since an authorized affiliate of the somebody who currently provides higher credit. Which have somebody in your life having a good credit score that cosign for you is even an alternative, nevertheless normally hurt its credit history for those who skip payments or standard on the financing.

Might you get credit cards that have good 570 credit rating?

Credit card people having a credit score inside range will get have to establish a safety put. Applying for a protected credit card could be the best option. not, creditors tend to want a protection put out-of $five-hundred – $step 1,000. You can even be capable of geting a beneficial “starter” charge card off a credit relationship. It is an unsecured credit card, however it comes with the lowest credit limit and you will highest attention rates.

Regardless, when you find yourself able to get approved to have a charge card, you must make your repayments promptly and maintain what you owe below 29% of credit limit.

Are you willing to score a consumer loan with a credit history away from 570?

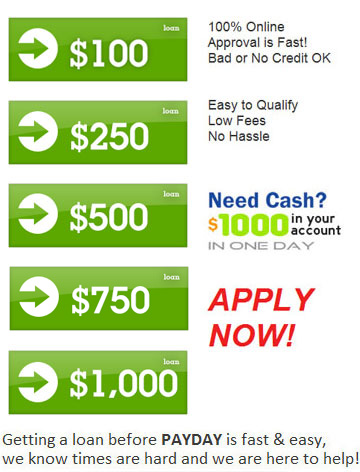

Hardly any unsecured loan loan providers usually approve your to have an individual financing having good 570 credit rating. Although not, there are several that work that have bad credit borrowers. But, unsecured loans from all of these lenders feature highest rates.

It is best to avoid payday loans and you will high-attract personal loans because they would a lot of time-identity personal debt issues and simply sign up for a much deeper decrease in credit score.

To build credit, applying for a card creator financing are a suitable option. Rather than providing the bucks, the money is actually placed in a checking account. When you pay off the loan, you get access to the money as well as people interest accrued.

Must i rating home financing with a credit score out of 570?

Old-fashioned mortgage lenders will likely refuse the home loan application having a credit score off 570, because the minimal credit score is approximately 620.

But not, of these in search of trying to get an FHA mortgage, candidates are just necessary to has a minimum FICO get out of five-hundred to help you qualify for a down-payment around 10%. Individuals with a credit rating regarding 580 can be eligible for an excellent down-payment as low as step 3.5%.

Should i score an auto loan which have a beneficial 570 credit history?

Really automobile lenders will not provide so you’re able to individuals with good 570 rating. When you’re able to find approved having an auto loan with an effective 570 get, it could be pricey. The common credit history you’ll need for car and truck loans may vary. not, if you possibly could improve your credit history, bringing a motor vehicle might be convenient.

How-to Increase an effective 570 Credit history

A dismal credit rating will reflects a reputation borrowing errors otherwise mistakes. Such, you’ve got specific skipped repayments, charges offs, foreclosures, and even a case of bankruptcy popping up on the credit history. Also, it is likely that you simply haven’t established credit anyway. No borrowing is in fact like less than perfect credit.

step 1. Argument Bad Levels in your Credit file

It is best to get a copy of one’s 100 % free credit report off all the  around three major credit bureaus, Equifax, Experian, and you may TransUnion to see what’s are reported in regards to you. If you discover any negative points, you’ll be able to hire a card repair organization such as Lexington Laws. They could make it easier to dispute them and possibly have them removed.

around three major credit bureaus, Equifax, Experian, and you may TransUnion to see what’s are reported in regards to you. If you discover any negative points, you’ll be able to hire a card repair organization such as Lexington Laws. They could make it easier to dispute them and possibly have them removed.

Lexington Legislation focuses on deleting bad points from your own credit history. He has more than 18 many years of experience in addition to their subscribers spotted more than 6 mil removals on their customers in 2021 by yourself.

- hard questions

- later money

- collections

- charge offs

- foreclosures

- repossessions

- judgments

- liens

- bankruptcies

2. Sign up for a card Builder Financing

Borrowing from the bank builder financing try payment financing which might be specifically designed in order to assist people who have less than perfect credit create otherwise reconstruct credit score. In reality, borrowing builder money not one of them a credit score assessment after all. Along with, it’s probably the lowest priced and you may easiest way to boost your credit ratings.

Having credit creator finance, the money sits from inside the a checking account up until you’ve done all of the your own monthly obligations. The mortgage money is reported to a single credit agency, that provides your own fico scores an increase.

step 3. Score a guaranteed Bank card

Providing a secured charge card is a fantastic solution to expose credit. Safeguarded credit cards functions comparable because the unsecured handmade cards. Really the only difference is because they want a protection deposit which also acts as your credit limit. The financing card company keeps your deposit for people who end deciding to make the lowest fee otherwise can’t pay the charge card harmony.

cuatro. End up being a third party Associate

While close to somebody who has sophisticated borrowing, as an authorized member on their borrowing account, ‘s the quickest means to fix raise your fico scores. Their username and passwords gets put in your credit report, that will improve your fico scores quickly.

5. Make Borrowing by paying Your Book

Sadly, lease and you can electric repayments commonly usually stated toward about three borrowing from the bank bureaus. Although not, for a little percentage, lease reporting properties could add your instalments toward credit file, which will help your replace your credit ratings.

Where to go from this point

It is very important see and that products compensate your credit score. Perhaps you have realized in the picture below, you’ll find 5 issues that make up your credit rating.

Pay down your balances and maintain their borrowing from the bank use under 30%. You should also keeps different types of borrowing levels to establish a strong borrowing combine as it accounts for doing 10% of FICO score. So, you will need to keeps one another cost and you will revolving credit popping up on the credit file.

Naturally, you must work with while making quick payments from this point to the aside. Actually you to definitely later payment can be very damaging to the credit.

Length of credit score as well as plays a significant part on your fico scores. We wish to tell you prospective creditors you have an extended, confident commission history.

Strengthening good credit will not takes place overnight, you could naturally speed up the procedure by simply making the fresh new right moves. Thus bring Lexington Rules a call for a no cost borrowing from the bank consultation at the (800) 220-0084 as well as have come fixing the credit now! The earlier you begin, the sooner you’ll end up on your way to with a good credit score.