Contents:

Give your position a breathing space by including current volatility into your stop loss order. It should not be used as a standalone indicator that decides your entry, stop, and take-profit. The most important thing you need to know is ATR does not measure or predict trend direction. If you are interested in using Tradingview, you can try out thePro membership FREE for 30 days.This is an excellent time to check out the powerful features of Tradingview charting. An expanding ATR indicates that there is an increase of volatility in the market.

Low ATR values confirm ranging markets and buy/sell signals can be provided by Stochastics crossovers in overbought and oversold zones. By default, the ATR indicator displays a moving average of the last 14 sessions. Just like most indicators, it can be customized to include as many sessions as the trader wishes.

Using ATR and RSI is very easy, especially on the Margex platform. Log into your Margex account and head to Indicators to search for ATR and RSI, then add them to your trading strategies. To determine your trailing stop loss, use 1.5 x ATR, which will give good room for stop loss hunting.

What Is the Average True Range (ATR)?

Where TR is current bar’s true range, ATR1 is previous bar’s ATR, and a is the smoothing factor – not the period, but a number calculated from the period and reaching values from 0 to 1. Before you trail the position in a trade, you should mark out all important areas, including your support and resistance levels. This will help you to determine where to set your stop loss. The ATR indicates an increase in volatility in the market as the ATR increases or expands. An expanding ATR in either an upward or downward direction signals an increase in volatility for that particular price, as seen in 1 and 2 of the labeled image.

Calculate the true range for each period within the specified time frame (e.g., 14 periods). If you want to ride massive trends in the markets, you must use a trailing stop loss on your trades. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The VIX is a measure of implied volatility, based on the prices of a basket of S&P 500 Index options with 30 days to expiration. While during the lower volatility period, a wide stop would be a waste.

How to Calculate Average True Range?

High values suggest that stops be wider, as well as entry points, to prevent having the market move quickly against you. With a percentage of the ATR reading, the trader can effectively act with orders involving proportionate sizing levels customised for the currency at hand. After the spike at the open, the ATR typically declines most of the day. The oscillations in the ATR indicator throughout the day don’t provide much information except for how much the price is moving on average each minute.

The price was in a bullish trend during the first highlighted phase. The STOCHASTIC was above the 80 level, confirming a strong bullish trend. Because of the absence of large wicks and the orderly trend behavior, the ATR was at a low value. This shows a low volatility and high momentum trending market.

Chandelier Exit

If you were looking at a 14-day period, you’d look at which 14 days of data had the highest numbers. Then you’d add them together and divide by 1/n, where n is the number of periods. This will give you the previous ATR, which you need for the calculation below. The average true range can help identify where to place your stop with a multiplier of the ATR. This multiplier can be 2%, 10%, or 20% of the average true range. ATR with period of 50 will be much slower and smoother than ATR with period of 5.

ATR Targets 40 New Aircraft Deliveries This Year Air Transport News – Aviation International News

ATR Targets 40 New Aircraft Deliveries This Year Air Transport News.

Posted: Thu, 30 Mar 2023 07:00:00 GMT [source]

Only if a valid atr technical indicator signal occurs, based on your particular strategy, would the ATR help confirm the trade. Day traders can use the information on how much an asset typically moves in a certain period for plotting profit targetsand determining whether to attempt a trade. Whether the number is positive or negative doesn’t matter. Once you figure out the highest value, you’ll use that in your calculation.

Interpreting the Average True Range Indicator

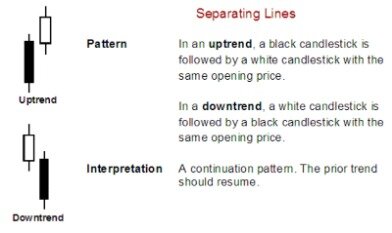

A stop order will not guarantee an execution at or near the activation price. Once activated, they compete with other incoming market orders. Another idea to use ATR is to project the trading day’s extremes. A reversal bar with increased ATR indicates the aggressiveness of the move. And expansion of ATR value might indicate selling or buying pressure.

This is because instead of momentum, an average true range indicator calculates the maximum possible price movement at any point in time. This helps traders set their entry price and exit prices according to their trading strategy. The average true range is a tool to measure the volatility of commodities, but it can also be used for other types of assets.

- However, the price of the stock’s already risen above the average; hence it is not advisable to assume that the price will rise further.

- A prolonged period of low ATR values may indicate a consolidation area and the possibility of a continuation move or reversal.

- A trailing stop-loss helps you set a stop not at a specific price point but at a percentage level.

- The average true range won’t tell you when to go long or short in trades … It doesn’t even care what your bias in the market is.

Otherwise, there are high risks that you will be taken off the market fast. On the contrary, trades in periods of low volatility should be marked with narrow stop-loss orders. To catch a potential breakout, find a period when the ATR indicator is low or flat. This approach will allow you to enter the trend at the very beginning of its formation.

The table below shows weights of each bar’s true range in the resulting ATR. It compares the three methods, all with period length set to 5. For example, with period set to 5, each of the last 5 days has exactly 20% effect on today’s ATR. If you set a longer period, like 40, each of the last 40 days has only 2.5% effect and, as a result, ATR will be much slower to reflect volatility changes. Adding an exponential moving average to the ATR can provide interesting insights and offer an objective use case.

The ATR can signal if volatility is present and strong enough for a trend to potentially form. A rising ATR shows you a stock is moving and that there’s strength coming into the move. The effect of period setting on ATR is calculation method specific. I won’t tell you which is “best”, but I can tell you which periods appear to be the most popular based on trading literature and various software default settings. In the screenshot below, the Keltner channel shows the average pip range over the last 7 days.

- Welles Wilder’s book New Concepts in Technical Trading System.

- In this example, the first quarter of the chart includes an uptrend, followed quickly by a breakdown.

- Can also select the ATR Line’s color, line thickness and visual type .

- If the initial trade is profitable, and as the ATR changes, the trader might adjust the stop order such that it’s always 2x the ATR.

Even though the stock may be trading beyond the current ATR, the movement may be quite normal based on the stock’s history. The ATR is a tool that should be used in conjunction with an overarching strategy to help filter trades. The time period to be used in calculating the Average True Range.

Period Does Not Always Mean Number of Days

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The ATR was initially developed for use in commodities markets but has since been applied to all types of securities. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. Can toggle the visibility of the ATR Line as well as the visibility of a price line showing the actual current value of the ATR Line.

These Indicators Are Pointing To a Rally In Bank Of America, Soon – MarketBeat

These Indicators Are Pointing To a Rally In Bank Of America, Soon.

Posted: Mon, 27 Mar 2023 07:00:00 GMT [source]

(available in %)NoYesNo, only averageIR% or $NoYes YesOne indicator isn’t necessarily better than another. The chart lays out the difference between Average True Range, Average Day Range, and Intraday Range. All charts are provided by TradingView, the charts I personally use.

Again, you can see the weight of last 20 bars is only 64.15% in the original Wilder’s ATR with period set to 20. Average True Range takes only one parameter and that is the period length. Some users of the ATR Calculator have asked the question which period setting they should use – which is “the best”.

Aptargroup $ATR Technical Pivots with Risk Controls – Stock Traders Daily

Aptargroup $ATR Technical Pivots with Risk Controls.

Posted: Sat, 25 Mar 2023 13:15:00 GMT [source]

Once you are more familiar with the ATR indicator, you may wish to experiment using different periods to find out what works best for you. When using the ATR to trade, you will typically look for securities that have been trending in a particular direction and have recently seen a spike in volatility. This can be an indication that the security is about to make a move, and you can use the ATR to help you set your stop loss and take profit levels. Although ATR doesn’t reflect the market direction, it may help to filter trends, trade in periods of breakouts, and set stop-loss orders. Remember that the indicator doesn’t show the price direction. It reflects the strength of volatility but never shows where the market moves.

Based on this, https://trading-market.org/ markets have wide price ranges, while less volatile markets have narrow price ranges. While longer timeframes will be slower and likely generate fewer trading signals, shorter timeframes will increase trading signals. For example, a shorter average, such as 2 to 10 days, is preferable to measure recent volatility . For gauging longer-term volatility, on the other hand, a 20 to 50-day moving average should be used. The following guide will examine the ATR indicator, how it is calculated, how to apply it to your trading strategy, as well as the pros and cons of using this technical analysis tool. The ATR is a moving indicator and changes with the degree of volatility in price action.